Why Digital Transformation is Essential for Accountants and CPA's in 2023

What is Digital Transformation?

Digital transformation has been one of the most powerful innovations in recent years, and its importance continues to grow with each passing day as technology evolves rapidly. As an accountant or CPA, staying abreast of this ever-changing landscape has become increasingly critical in order to remain competitive and successful. In 2021 alone, there has been a tremendous shift toward digitized accounting processes, including cloud computing, mobile applications, analytics systems, and even robotic process automation. But what will digital transformation mean for the future of accounting? We’ll explore this topic further by taking a peek into 2023 to see how accountants & CPA’s can use emerging technologies to enhance their offerings and adjust accordingly so they don’t get left behind in the growing movement toward digitization.

What are the Benefits of Digital Transformation in Accounting?

Digital transformation in accounting can provide numerous benefits that help streamline the financial reporting process and increase accuracy and efficiency. It can simplify data management tasks for professionals by reducing manual processes and enabling the automation of specific procedures. Automation can reduce errors associated with human input, as well as improve accuracy when it comes to journal entries, billing invoices, and other documents related to financial reporting.

Digital transformation in accounting offers many advantages, including:

-

Increased Efficiency

Allows for faster processing of transactions and data, which can save time and money for the organization. It also provides more accurate tracking of financial information, which helps to ensure accuracy in reporting. Additionally, digital transformation methods allow access to data from anywhere, which means that CPAs and accountants can perform their duties more quickly and accurately.

-

Improved Security

Helps to protect the organization’s data by using advanced security measures such as encryption and access control systems. This reduces the risk of unauthorized access or manipulation of the data.

-

Increased Accuracy

Automates processes and reduces manual errors that may be caused due to human mistakes. Additionally, digital tools allow for more accurate forecasting and analysis of financial information as well as creating more reliable records that are easier to track and access.

-

Improved Collaboration

It also enables team members to easily share information and work on projects in real time, with streamlined collaboration tools providing easy access to the information they need to manage financial data, reporting, and invoice generation.

-

Advanced Insights

Enables CPAs and accountants to gain insights that would otherwise be difficult to obtain through manual data processing. For example, artificial intelligence (AI) can help to identify patterns in financial data, which can provide valuable information for the organization. Additionally, predictive analytics can be used to forecast future trends in accounting that could prove beneficial for decision-making.

-

Cost Savings

Helps organizations save money by optimizing their processes and eliminating redundant tasks. It also helps to reduce costs associated with manual labor, such as hiring additional staff or outsourcing services. Digital transformation also allows organizations to streamline their operations, thus reducing operational costs as well.

-

Faster Decision Making

Reduces decision-making time by providing real-time analytics, allowing teams to make decisions quickly and accurately. Additionally, digital tools can provide additional insights which can be used to improve business processes.

Overall, digital transformation in accounting and CPAs can provide organizations with a number of advantages that traditional methods cannot. By leveraging digital tools and processes, companies can reduce costs, increase efficiency, improve security, and gain valuable insights for better decision-making. Ultimately, this will enable them to become more competitive in the market.

Top Collaboration Tools for Accountants

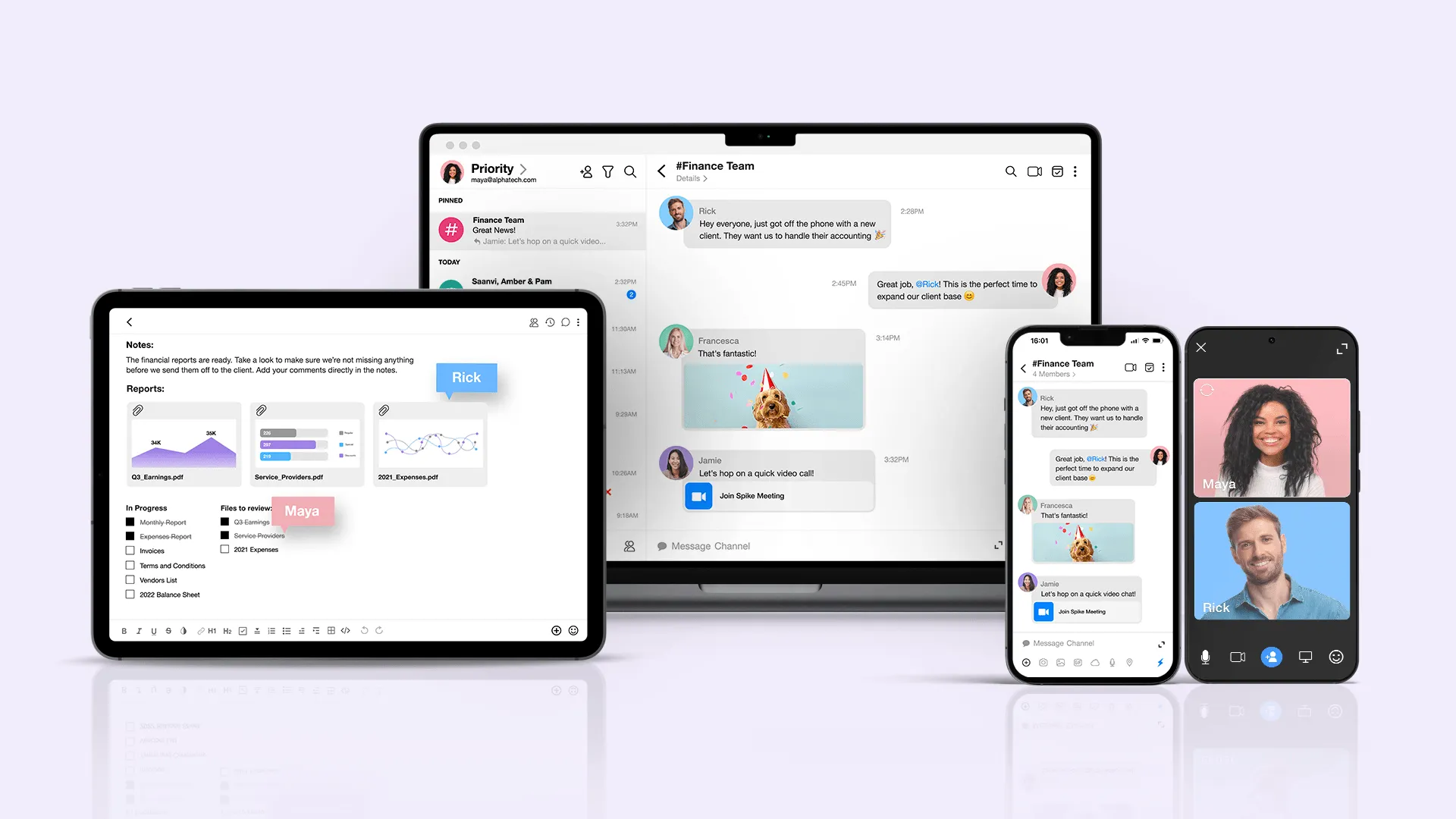

1. Spike

Spike Teamspace is an email-centric tool that integrates channels, groups, chat, tasks, and notes directly within your email inbox. Through streamlined communication and task management features, accountants can easily share and enjoy real-time collaboration on documents, as well stay in touch with clients on dedicated Channels or colleagues within Groups. File Management

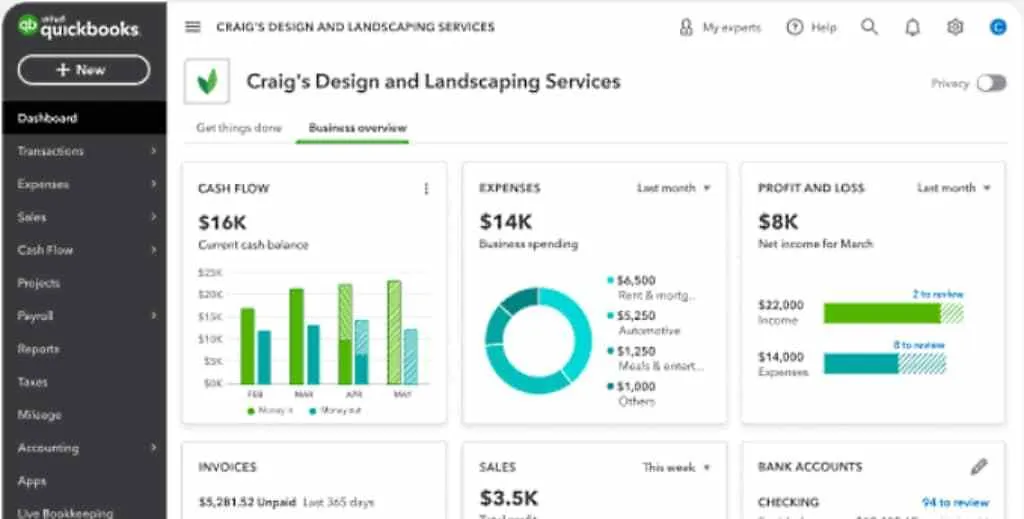

2. QuickBooks

QuickBooks is a widely used accounting software that helps businesses manage their financial data, track expenses, create invoices, and generate financial reports. QuickBooks Online Accountant, specifically designed for CPAs and accountants, allows easy collaboration with clients, simplifies bookkeeping tasks, and allows for real-time access to financial information.

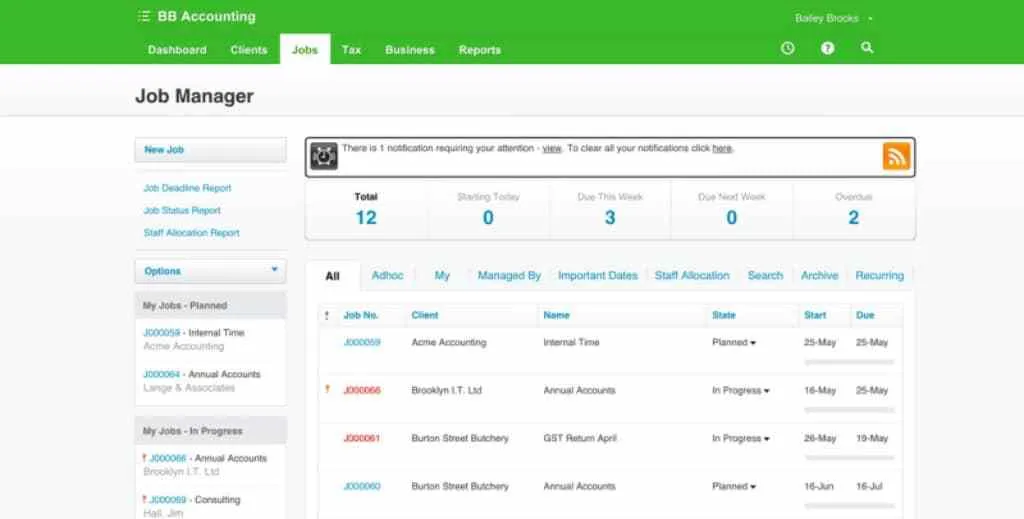

3. Xero Practice Manager

Xero Practice Manager, formerly WorkflowMax, is a comprehensive project management and job tracking tool for accounting firms. It enables collaboration on tasks, time tracking, project management, and client communication. It’s particularly useful for managing client engagements and ensuring tasks are completed efficiently.

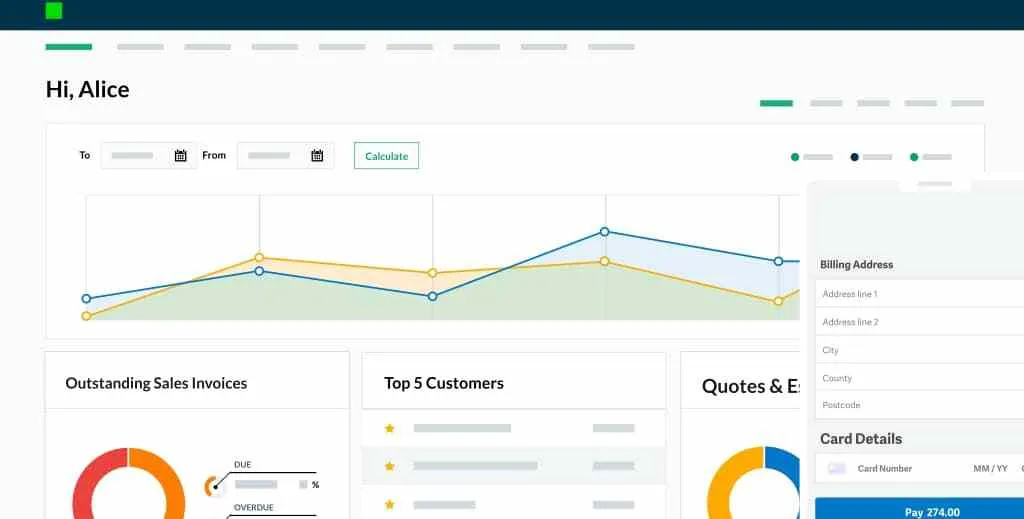

4. Sage Business Cloud

As one of the most popular accounting tools around, Sage Business Cloud provides cloud-based accounting and financial management solutions for countless CPAs and accountants. While the collaboration aspect may be as well known, Sage’s software allows for efficient management of accounting processes, such as invoicing, expense tracking, and financial reporting, that supports collaboration among team members.

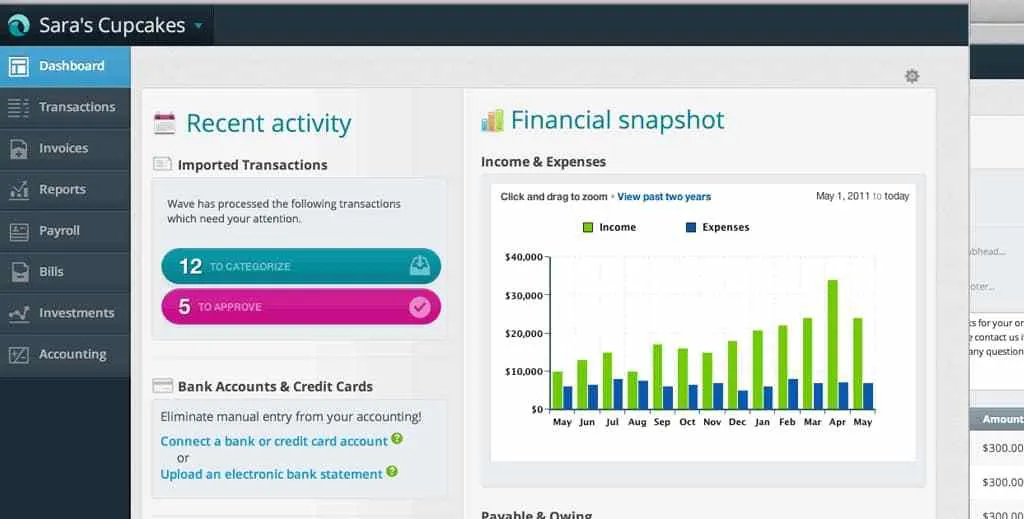

5. Wave

Wave offers accounting software tailored for small businesses and freelancers. It provides features for invoicing, expense tracking, and financial reporting. While it may not have extensive collaboration features, its user-friendly interface can help simplify financial tasks and potentially improve collaboration within small accounting teams.

Cloud Accounting

Cloud accounting is a revolutionary tool that has enabled accountants and CPAs to stay ahead of the curve when it comes to managing their clients’ financial data. With the availability of cloud-based software, accountants and CPAs are able to access real-time financial information from anywhere in the world and provide quicker insights for their clients. This has enabled accountants and CPAs to be more efficient in their work and provide better advice on financial situations.

Cloud accounting has allowed for greater collaboration between the accountant and client, enabling them to discuss any queries or issues in real-time by easily sharing documents, spreadsheets, and reports via the cloud. This is especially beneficial for clients who are spread out across multiple locations.

Cloud accounting also provides up-to-date and accurate information quickly, eliminating the need for manual data entry. This helps accountants and CPAs to get a better understanding of their client’s financial situation more quickly, allowing them to provide better advice in a shorter amount of time.

By leveraging cloud accounting, accountants and CPAs are able to provide a higher level of service to their clients. This allows them to stay ahead of the competition by offering better services at competitive rates. In addition, cloud accounting eliminates manual errors associated with traditional accounts management, further contributing to accuracy and efficiency in an accountant’s work.

Ultimately, cloud accounting provides accountants and CPAs with the ability to provide better advice and services to their clients, resulting in a greater level of client satisfaction.

Robotic Process Automation

Robotic Process Automation (RPA) is an emerging technology that has the potential to revolutionize accounting processes. RPA automates routine tasks such as data entry, invoice processing, tax calculations, and financial reporting, eliminating redundant manual labor and streamlining processes. With its automation capabilities, RPA can help accountants and CPAs reduce errors, save time and money, and generate accurate financial reports.

RPA can also be used to automate compliance processes, allowing accounting professionals to quickly check for accuracy and ensure that information is up-to-date with the latest regulations. This automated process of monitoring can save significant amounts of time.

By leveraging the power of RPA, accountants and CPAs can do more with less and increase their overall efficiency. With RPA, they are able to quickly identify areas in need of improvement or optimization and then make necessary changes without having to manage complex manual processes. Additionally, RPA can be used to easily integrate data from multiple sources and create detailed financial reports in a fraction of the time it would take to prepare manually.

With its automation capabilities, RPA can help accountants and CPAs stay competitive and efficient in a rapidly changing market. As businesses continue to adapt to new technologies, those who leverage the power of RPA will be well-positioned to take advantage of the latest innovations and succeed in an ever-evolving accounting landscape.

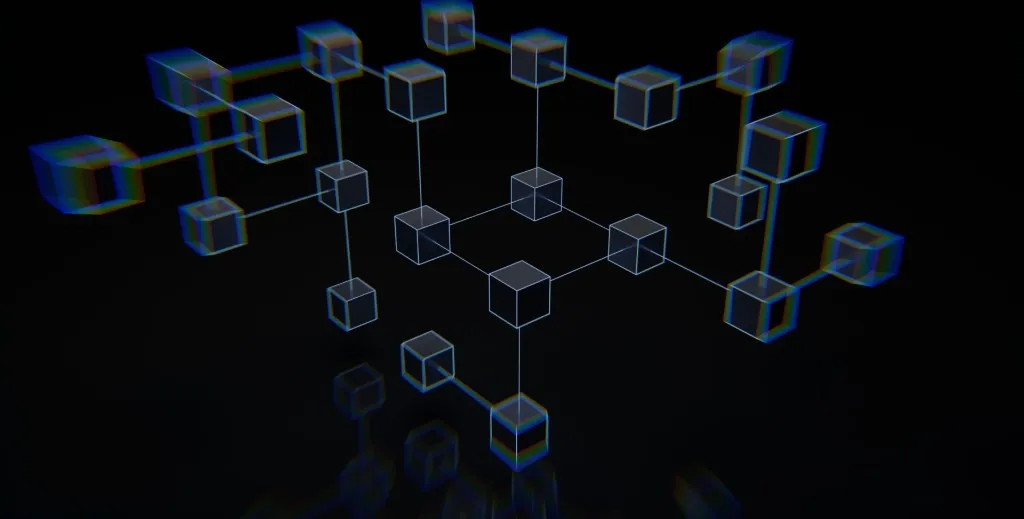

Blockchain Technology

Blockchain technology is a revolutionary new way of storing and sharing data, making it an invaluable asset to accountants and CPAs. It allows for secure transactions that are completely transparent and immutable, meaning that all changes in the ledger can be seen by anyone with access to the blockchain. This ensures accuracy and security when dealing with client records or financial documents.

Blockchain technology also allows for faster processing of transactions and data exchange, which is extremely beneficial to CPAs and accountants. Transactions can be completed almost instantly, making everyday accounting tasks easier and more efficient. With its distributed ledger system, blockchain technology also makes improves fraud detection, making it easier to spot any discrepancies or fraudulent activity.

The use of blockchain technology can also help to reduce costs associated with paperwork as the process becomes automated. This leads to more accuracy and fewer errors when it comes to audits or other financial operations. In addition, CPAs and accountants can benefit from using smart contracts, which are computer programs that execute certain tasks according to predetermined rules set out by the user. Smart contracts can be used to automate certain aspects of accounting and financial operations, further reducing costs as well as time spent on administrative tasks.

Blockchain technology is a powerful tool for CPAs and accountants that can help them save money, reduce risk, and complete tasks more efficiently. It’s no wonder that the use of blockchain is becoming more prevalent in the accounting and finance industry. As technology continues to advance, it’s likely that accountants and CPAs will continue to find new ways to leverage the power of blockchain for their business needs.

Conclusion

The profession of accounting is evolving. The work that CPAs and accountants do will be drastically different in the next five to ten years than it is today. Therefore, it’s important for those in the profession to begin preparing themselves now for the digital transformation that is sure to take place. By understanding the importance of digital transformation and its impact on the accounting profession, CPAs and accountants can position themselves for success in the years to come.

You may also like

The Best Billing Software for Freelancers and SMBs

Invoicing can be a bit of a drag but it doesn’t have to be that way. Check out Spike's picks for the best invoicing software designed to make your life a little easier.

Read MoreMastering Email Triage for Busy Professionals

Just like a battlefield medic, email triage helps you quickly identify the critical messages that need your immediate attention, while efficiently sorting the rest for later or delegating them altogether.

Read MoreElevate Your Email Game: The 12 Best AI Writers to Try in 2024

Struggling with emails? Ditch writer's block! This guide reviews the TOP 12 AI email writing assistants to craft killer emails in seconds. Improve efficiency & get back to what matters most!

Read More